10 Questions and Answers About Investing Your Tax Refund

Getting a tax refund? Axos Invest SVP Tracy Gallman talks with Meeder Investment CEO Bob Meeder about how to best leverage those dollars into your investment strategy.

Replenishing rainy day funds and paying down high-interest debt are first-step refund uses.

The stock market may provide a greater real rate of return over most alternatives.

A disciplined investing approach with regular contributions may accumulate significant dollars.

Millions of Americans sit down every year to figure out where they stand with their taxes. While 2021 wasn’t the simplest of tax years to say the least, tax refunds are winging their way into bank accounts nationwide. So what should you do with your returned cash?

Axos SVP Tracy Gallman sat down with Meeder Investment CEO and President Bob Meeder to talk about some of the smart strategies to consider as you decide how to use your refund to boost your current investment strategy.

Q | Tracy Gallman

Obviously, the American Rescue Plan and elements of that legislation, like the Child Tax Credit, are making 2021 returns more complicated for many and making refunds much tougher to predict. With that kind of extra uncertainty, what are some smart ways people can use their returns wisely to bolster their investment?

A | Bob Meeder

The first thing that an investor should do if they get a tax refund is pay off credit card balances and any high interest rate debts. The average interest rate on a credit card is around 18%. Once debt is reduced, then invest refund dollars into mutual funds that meet their long-term objectives.

Q | Tracy Gallman

Do you think that after they've paid down debt, they should consider cash and investments or just investments?

A | Bob Meeder

I always believe an investor should have a rainy-day fund with three to six months of living expenses. Have that in a conservative investment so that if something were to occur, they could draw on that without any market risk to those assets. After a cushion has been established, then they should have a long-term investment in place for themselves.

Q | Tracy Gallman

Let's talk about inflation. This is certainly on everybody's mind these days with diminished buying power. How does putting your tax refund into your portfolio better protect your money?

A | Bob Meeder

Over the long haul, we believe a prudent way to hedge money against inflation is to invest in the stock market. Even though we've seen volatility in the stock market, over the long haul, we believe the stock market will provide a higher real rate of return. The real rate of return is an investment return minus inflation. Typically, money markets don't provide a significant real rate of return as an average. Yield is similar to inflation, so the real rate of return is zero. Over the long haul, investing in the stock market may potentially result in a higher real rate of return than alternatives.

Q | Tracy Gallman

With inflation already climbing up over 7% and possibly higher, what type of return in the stock market would even keep a client equal?

A | Bob Meeder

We’ve got a study on this over a longer term timeframe of 10 to 15 years. When you look at almost every 10-year period, the stock market has provided a real rate of return greater than inflation. When you factor in dividends and the return of the stock market, it averages about a 5% real rate of return, meaning after inflation. That's significant as when compared to bonds, which are about 1 to 1.5%. The stock market is your best bet over the long term.

Q | Tracy Gallman

For those clients who are concerned about the risk and the volatility and uncertainty, perhaps a solution is to take a little more balanced approach. Keeping some money in a rainy day fund combined with an investment rather than just the rainy day fund.

A | Bob Meeder

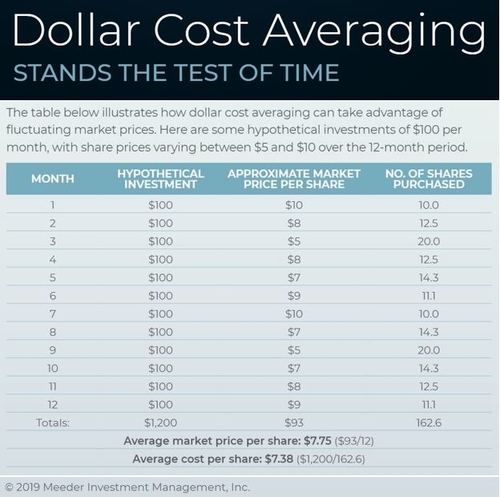

The more moderate type of investor could do a dollar-cost averaging approach. They could just do a little bit of investing into an investment portfolio, a little amount each month. That will enable them to buy at some lower prices over time as the market fluctuates.

And if they're more conservative or moderate, they should look at more balanced types of investments. So yeah, if a person really understands their risk tolerance, they should not have an aggressive portfolio. As soon as they're more aggressive than they should be, and the market turns down, they'll panic and sell, which is the wrong thing to do. So they’ve got to get that right risk profile of their investments to match their risk tolerance.

Q | Tracy Gallman

As people think about their refund, perhaps retirement will come to mind. Maybe they're a newer investor who hasn't set up a traditional or Roth Individual Retirement Account (IRA). Or perhaps a refund check will be used as the annual IRA contribution for someone who’s already invested. What should investors be thinking about when it comes to their IRAs?

A | Bob Meeder

If they can take a refund and put money away in an IRA versus just a regular savings account, that would be the best long term decision. That IRA money can grow on a tax-deferred basis. They’ve got to be able to say, I will put this money away and it's going to stay there and I'm not going to need to touch it. If they can't say that, then the IRA approach is probably not the best approach. But there's the traditional IRA, which allows you to use the amount that you put in to reduce that amount from your taxes. Then there's the Roth that allows you to put in after-tax dollars. If you max out your traditional IRA and you have more that you want to put in, you can put those after-tax dollars in a Roth IRA to let the money grow.

Q | Tracy Gallman

What about setting up IRAs for kids and grandchildren to help them pay for college and start a nest egg? Is that another good use of tax refund money?

A | Bob Meeder

Absolutely. For those people who have that extra cash so they can make those contributions to their kids or grandchildren, that's a great idea. And they could also look at 529 plans. So IRAs and 529 college saving plans are great vehicles for that opportunity.

Q | Tracy Gallman

There's so much volatility in the market. How smart is it to put a tax refund into an account in the form of cash so you're immediately ready to act and buy in it if a premium stock has a bad day?

A | Bob Meeder

First of all, I think you should look to have a diversified portfolio. If people buy just a few stocks, they can hit more home runs that way. But if those stocks don't work out, they're more vulnerable on the downside. So that's why I think having a diversified portfolio is the best solution. If the investor has a long-term timeframe, then putting the money to work right away isn’t a bad idea. But if they're uncomfortable doing that, they could use a dollar-cost averaging approach instead.

Q | Tracy Gallman

Within Axos Invest, we have access to mutual funds for any investor, many at low entry points. I think some of your own Meeder mutual funds have been tracking at about $9 or so per share. So even if your tax refund is $200, maybe $2,000, getting into a diversified investment vehicle like a mutual fund is an option, right?

A | Bob Meeder

Absolutely. And again, build up that rainy day savings plan first. Then once that's done, invest as much as you can consistently over time and stick to that plan. It's amazing what one can accumulate over time. And it doesn't have to be a large amount of money. If they just do it consistently and have a disciplined savings approach, they're going to be able to accumulate significant dollars. And then if they can, they should stick to their investment plan.

Invest as much as you can consistently over time and stick to that plan. It's amazing what one can accumulate over time.

Q | Tracy Gallman

About four in 10 Americans say building or replenishing their emergency fund is a priority in 2022. What are some clever ways to make that cash most effective in crafting a financial safety net?

A | Bob Meeder

I would do what I call an automatic account builder. Every two weeks or every month, they have money taken from their checking account or wherever and it's put into this emergency fund. It just happens consistently like clockwork every two weeks, every month, whatever. And it just keeps happening. That's the best way to do it. Not making someone write out a check or going through the process.

Q | Tracy Gallman

So think about using your tax refund money as a foundation to set up an automatic investment plan for your emergency fund in your checking or money market account. But at the same time, shouldn’t you also set up an automatic investment plan into your investment account to dollar-cost average in?

A | Bob Meeder

I totally agree. I think if one can do that, they'll be miles ahead of the vast majority of investors or the vast majority of Americans.

AXOS INVEST

Invest and earn rewards.

Meet Bob Meeder and Tracy Gallman

Bob Meeder joined Meeder Investment Management in 1983, becoming President and CEO in 1995. Under his leadership, Bob has been instrumental in developing the firm’s tactical investment positioning system. Meeder's assets under management are over $25 billion, as of Dec. 2021.

Tracy Gallman has 30 years of experience in the financial services industry. Tracy previously served as Senior Vice President with LPL Financial and PFS Investments before overseeing all Axos Invest strategy and product development in 2021.

About Meeder Investment Management

Meeder Investment Management was founded in 1974. Located in Dublin, Ohio, Meeder has over 100 professionals serving the financial needs of individuals, corporations, and government entities, with over $25 billion in assets under management, advisement, and administration.

Meeder mutual funds are available now in the Axos Invest Self-Directed Trading platform.

Keep the Conversation Going

Check out Tracy and Bob's extended discussion about tactical investing, IRAs, and the emotion of the markets now.

Views expressed are as of February 23, 2022, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the author, as applicable, and not necessarily those of Axos Invest. Guests were not compensated for their participation in this interview and the discussion is not intended as an endorsement or recommendation of any particular investment product. Consult with your own tax, legal, accounting, and investment advisors before engaging in any transaction.

Mention of any mutual fund family does not constitute specific endorsement, advisement, guidance, or recommendation to buy, sell, and/or hold. Performance data represents past performance, which does not guarantee future results. Current performance may be lower or higher than the performance data quoted based on market fluctuations. Investors are always advised to carefully consider the investment objectives, risks, charges and expenses of any fund before investing. A prospectus including important mutual fund investment information is available upon request.

Axos Invest, Inc. Investment advisory services provided by Axos Invest, Inc., an SEC registered investment advisor. All rights reserved. For information about our advisory services, please view our ADV Part 2A Brochure, free of charge. Brokerage services are provided by Axos Invest LLC, a member of the Financial Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Commissions, service fees and exception fees still apply. Please review our commissions and fees for details.

Nothing contained in this material is intended to constitute legal, tax, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.